A Buyer submits a loan application to their lender. Taxes County Fees etc.

Understanding Mortgage Closing Costs Lendingtree

In NY this is referred to as the Uniform Residential Loan Application.

. At 217000 that puts the closing costs range at 17000-22000. The buyer has the right under the contract to inspect the property by bringing in one or more inspectors or contractors. However this is a common fee most buyers pay to the title company to close the transaction.

Within three business days the lender provides a Loan Estimate4 which consists of a breakdown of estimated closing costs5 3. OFFER TO PAY CLOSING COSTS. Offer to pay Closing Costs valid only in Florida on primary single family residence fixed-rate REFINANCE transactions where the loan amount is within conforming loan limits.

Some ancillary expenses on the other hand are negotiable and subject to the discretion of lenders and other real estate transaction partners. Each loan type conventional FHA VA and USDA sets maximums on seller-paid closing costs. There is a limit to how much a seller can pay for though.

Average closing costs for sellers range from 8 to 10 of the homes sale price including both agent commission about 6 of the sale price and seller fees about 2 to 4. Top 9 Strategies for Making an Offer on. Typical closing costs for sellers.

It is a transfer of an interest in land or the equivalent from the owner to the mortgage lender on the condition that this interest will be returned to the. However some lenders can take longer to approve the loan so be prepared for your buyer to request an extension. Department of Housing and Urban Development by The Urban Institute.

A mortgage in itself is not a debt it is the lenders security for a debt. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Our Florida closing cost calculator lets you estimate your closing costs based on your financial situation.

The typical closing time for a financed purchase one where the buyer is taking out a mortgage on the home theyre buying is at least 30 days. Second mortgages come in two main forms home equity loans and home equity lines of credit. The closing fee can actually be negotiated on your real estate transaction.

While the buyer typically pays a bulk of closing costs anywhere from 2 percent to 4 percent of the sales price know that you might have to. The money is held in what is known as an escrow account until closing and then is applied to the total purchase price including closing costs. The total sale price of a property negotiated between seller and buyer.

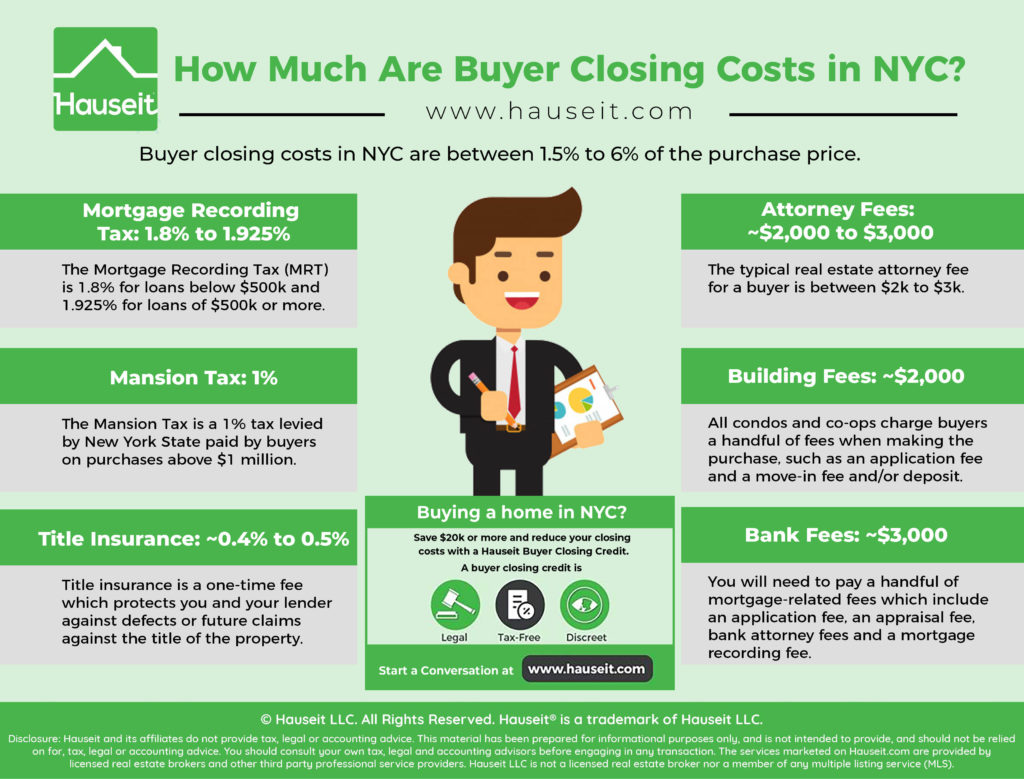

Buyers and sellers share the closing costs except that the buyer pays the lenders policy premium the seller pays the documentary transfer tax and the lender pays the mortgage tax. State Laws and Customs Toolkit Stewart Title Stewart Title 1980 Post Oak Blvd. Other buyer closing costs.

Closing shall proceed pursuant to the terms of this Contract and if r estoration is not completed as of Closing restoration costs will be escrowed at Closing. Closing costs are not a one-line item but rather a collection of multiple expenses. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

These costs are typically paid by the seller out of the proceeds. Real estate attorney fees. Educate yourself in advance about the cost.

But many sellers are eager to pay your closing costs in order to sell their home faster. With the median home price in the US. A simple property boundary survey costs anywhere from 100 to 600 while a mortgage survey costs an average of 500 according to data from HomeAdvisor which lists average costs for various.

An Evaluation of Title Insurance Price Disparity in the US. Closing Costs will solidify who will be responsible for covering the expenses associated with Closing a Residential Property Sale ie. This form is designed to complement the standard Florida RealtorsFloridaBar and CRSP contracts not the ASIS Florida RealtorsFloridaBar contract.

Not valid on Non-Qualified mortgages Jumbo Mortgages and Alternate Document Mortgages. If you are a buyer and are interested in closing costs check out our closing cost calculator. Property taxes may be paid annually on or before the last day of the year or semi-annually by December 31st and March 31st.

There is no cut-and-dried rule about whothe seller or the buyerpays the closing costs but buyers usually cover the brunt of the costs. This calculator helps sellers determine their total proceeds once closing costs have been deducted. Typically a closing fee on a cash deal for a home in Florida will run between 500-900 depending on the title company.

Tackle your home sale with hundreds of in-depth articles guides and resources backed by Americas top real estate agents rigorous research and data analysis. On a 500000 home this can be between. In addition to the closing costs listed above the buyer might also be responsible for paying.

Buyers Request for Repairs andor Remedies BRR-1 This form may be used by the buyer for requesting repairs in accordance with the sellers repair limit in a contract. If If the cost of restoration exceeds 15 of the Pur chase Price Buyer shall either take the Property as is together with the 15 or receive a r efund of deposits. This can limit the amount of cash you need to bring to closing.

Seller closing costs can range from 8 to 10 of the home selling price. This is typically 30 days in Florida. How much are seller closing costs.

The closing statement also would specify what was paid in real estate commissions to the buyers agent and the sellers agent. Mortgage closing costs range from 2-5 of a homes purchase price. Susan Woodward A Study of Closing Costs for FHA Mortgages report prepared in 2008 for the US.

We shall accomplish this by marking one of three checkboxes Buyer Seller and Both Parties presented in. How To Use Florida Closing Cost Calculator. A mortgage is a legal instrument which is used to create a security interest in real property held by a lender as a security for a debt usually a loan of money.

But if the transaction does not reach closing the earnest money deposit cannot be released without the express consent of both the buyer and the seller. Second mortgage types Lump sum. Registering deeds and documents for example is typically done for a flat fee.

Natural disaster certification fee. Beibei Zou Sudip Singh and David Eaton Who Should Regulate Insurance. Other popular closing time frames are 45 and 60 days which are agreed upon by the buyer and seller and usually chosen to align with relocation plans or another real estate purchase.

Many of the standard closing costs are fixed so buyers pay the same amount regardless of where financing is obtained. Buyers often negotiate to have sellers cover their closing costs. That can add up.

How Much Are Buyer Closing Costs In Nyc Hauseit

What Are Closing Costs For New Construction Southdown Homes

Closing Costs What The Buyer Seller Need To Pay

What Are Closing Costs For A Buyer In Florida Hauseit

What Are Buyer S Closing Costs In Florida 2021 Marina Title

What Are Buyer S Closing Costs In Florida

Common Closing Costs In Florida For Buyers Asr Law Firm

Homes For Sale Real Estate Listings In Usa Buying First Home Home Buying Real Estate

Mortgage Closing Costs For Buyers True North Mortgage

Florida Buyer Closing Costs How Much Will You Pay

Closing Costs For Home Buyers And Sellers Your Realtor For Generations Cheryl Facione Crs Gr Real Estate Tips Real Estate Infographic Real Estate Investing

Investopedia Buying First Home Home Buying Home Buying Checklist

Closing Costs When Paying Cash For A Property Financial Samurai

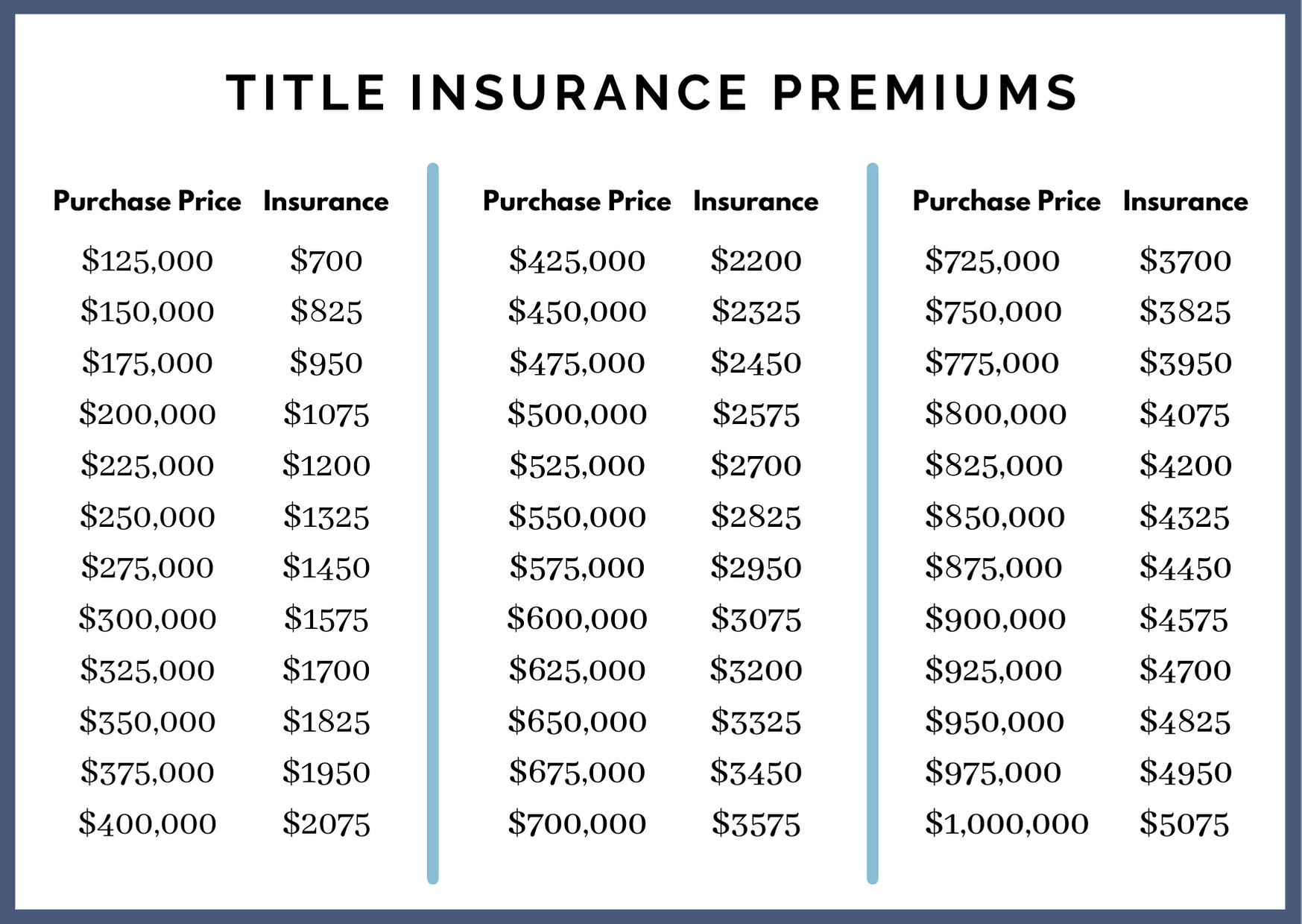

Getting Title Insurance Is One Of The Standard Steps Home Buyers Take Before Closing On A Home Purchase Title Insurance Title Insurance

What Are Buyer S Closing Costs In Florida

Homebuying And Closing Costs Nextadvisor With Time

Typical Closing Cost Who Pays What